Budgeting Tools

Budgeting Tools

Our easy-to-use budgeting tools help you track your income and expenses, set financial goals, and stay on track.

Planning Resources

Planning Resources

Access a wealth of resources to help you plan for the future, from saving for college to retirement planning.

Budgeting Tools

Budgeting Tools

Our easy-to-use budgeting tools help you track your income and expenses, set financial goals, and stay on track.

Budgeting Tools

Budgeting Tools

Our easy-to-use budgeting tools help you track your income and expenses, set financial goals, and stay on track.

Budgeting Tools

Budgeting Tools

Our easy-to-use budgeting tools help you track your income and expenses, set financial goals, and stay on track.

Planning Resources

Planning Resources

Access a wealth of resources to help you plan for the future, from saving for college to retirement planning.

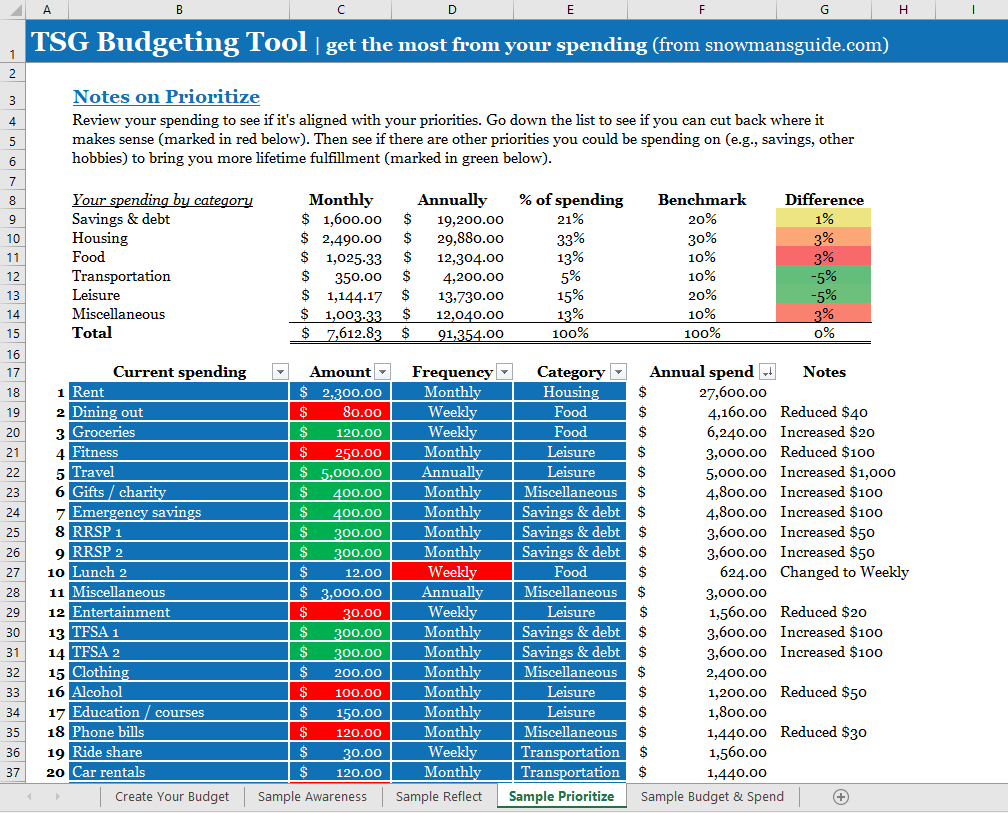

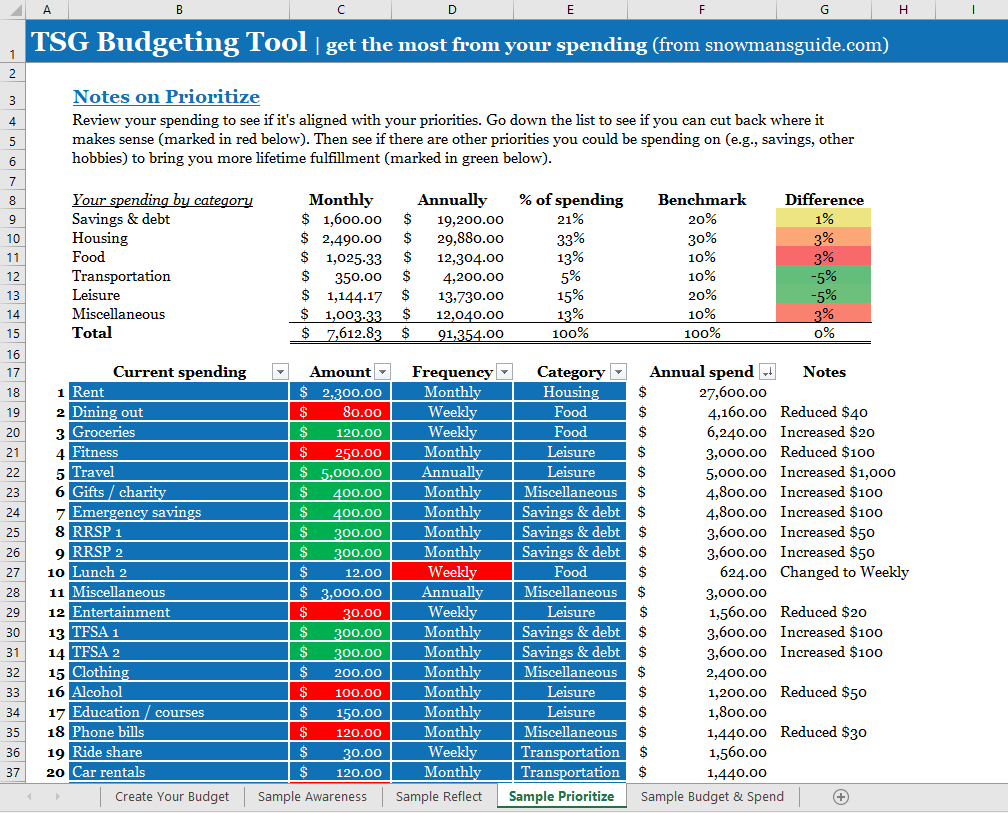

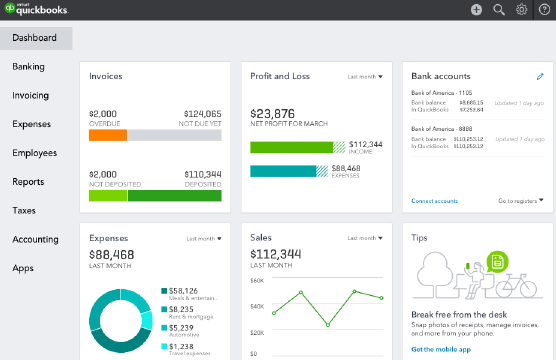

Budgeting tools

Budgeting tools are digital or manual resources designed to help individuals, businesses, or organizations manage their finances efficiently. These tools aid in tracking income, expenses, and savings, offering a clear picture of where money is going and helping users make informed financial decisions. By setting up categories for different types of expenses such as rent, utilities, groceries, or entertainment, budgeting tools provide users with a structured way to allocate their funds, avoid overspending, and plan for future goals

Benefits of Using Budgeting Tools

The primary benefit of using budgeting tools is improved financial control. By tracking every dollar spent, users can identify wasteful spending, reduce unnecessary costs, and allocate more funds towards savings or investment. These tools also promote long-term financial planning, helping users set and achieve goals such as paying off debt, saving for a house, or building an emergency fund. Additionally, many tools offer visual representations like charts and graphs, making it easier to understand complex financial data at a glance.

Benefits of Using Budgeting Tools

The primary benefit of using budgeting tools is improved financial control. By tracking every dollar spent, users can identify wasteful spending, reduce unnecessary costs, and allocate more funds towards savings or investment. These tools also promote long-term financial planning, helping users set and achieve goals such as paying off debt, saving for a house, or building an emergency fund. Additionally, many tools offer visual representations like charts and graphs, making it easier to understand complex financial data at a glance.

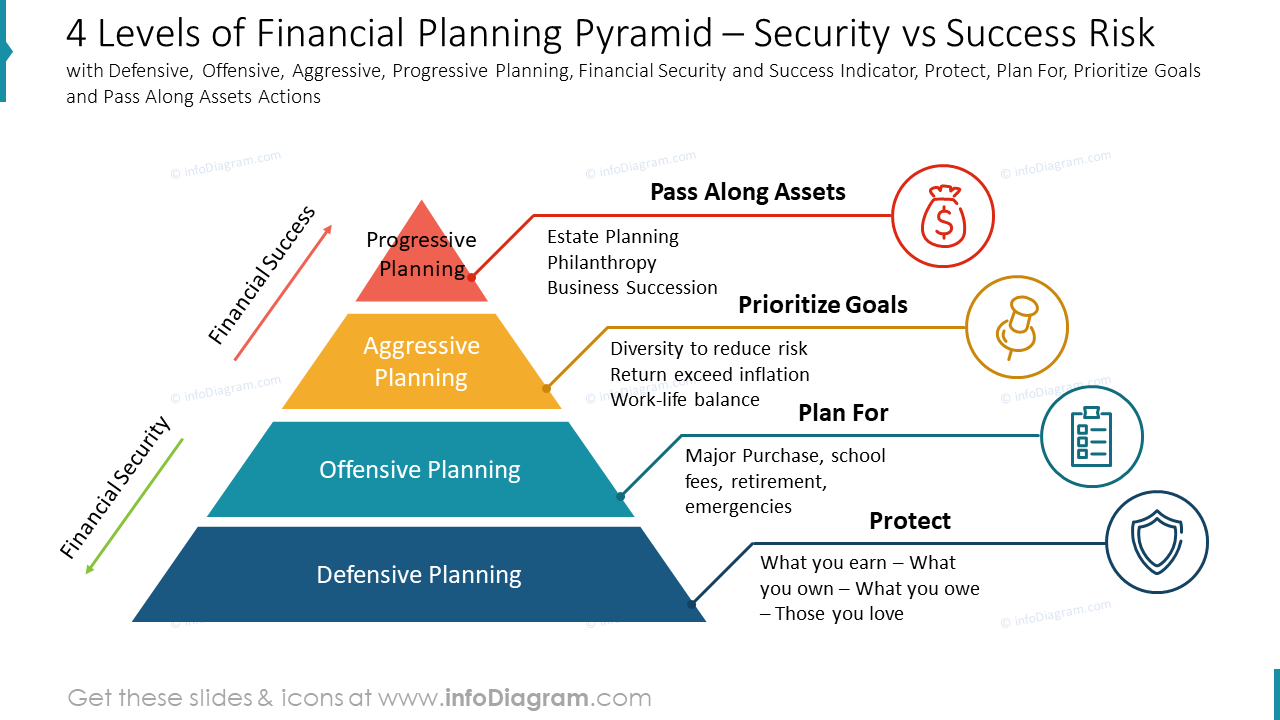

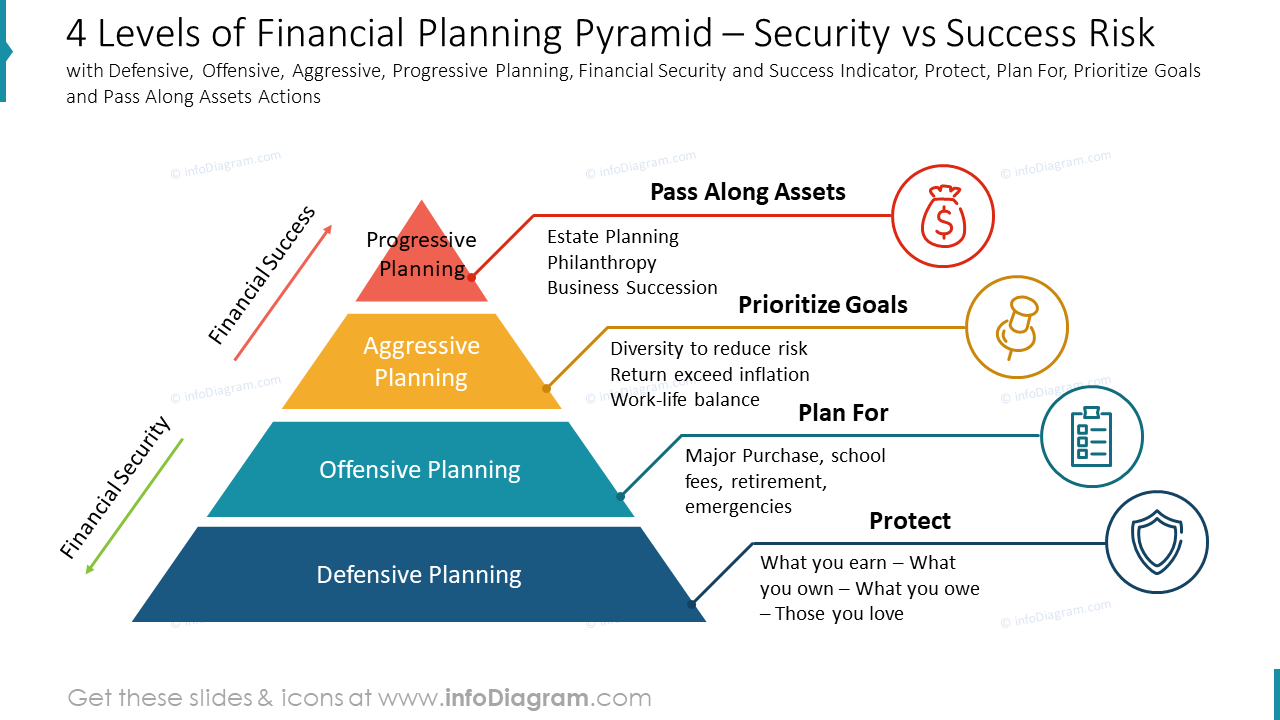

Financial advice

Financial advice refers to guidance or recommendations provided by financial professionals or tools to help individuals and businesses make informed decisions about their finances. This advice can cover a wide range of topics, including investments, savings, retirement planning, debt management, and tax strategies. The goal of financial advice is to improve a person’s financial well-being by offering personalized solutions that align with their short-term and long-term financial goals.

Benefits of Financial Advice

Seeking financial advice can provide a clear pathway to achieving financial goals. By offering expert insights, financial advice helps individuals and businesses make informed decisions, whether it’s about investing in the stock market, buying a home, or saving for retirement. A key benefit is the ability to develop personalized financial plans that are tailored to a person’s income, lifestyle, and future goals. Financial advice also helps reduce the risks of poor decision-making, such as investing in high-risk assets without understanding potential downsides or failing to save enough for retirement.

Benefits of Financial Advice

Seeking financial advice can provide a clear pathway to achieving financial goals. By offering expert insights, financial advice helps individuals and businesses make informed decisions, whether it’s about investing in the stock market, buying a home, or saving for retirement. A key benefit is the ability to develop personalized financial plans that are tailored to a person’s income, lifestyle, and future goals. Financial advice also helps reduce the risks of poor decision-making, such as investing in high-risk assets without understanding potential downsides or failing to save enough for retirement.

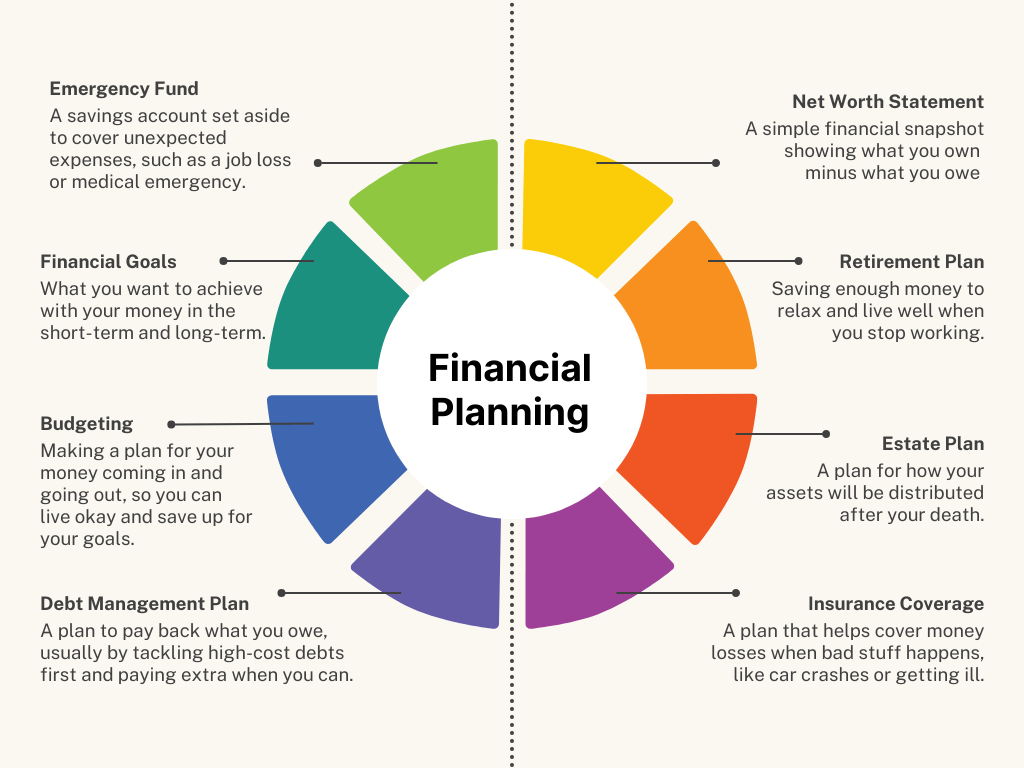

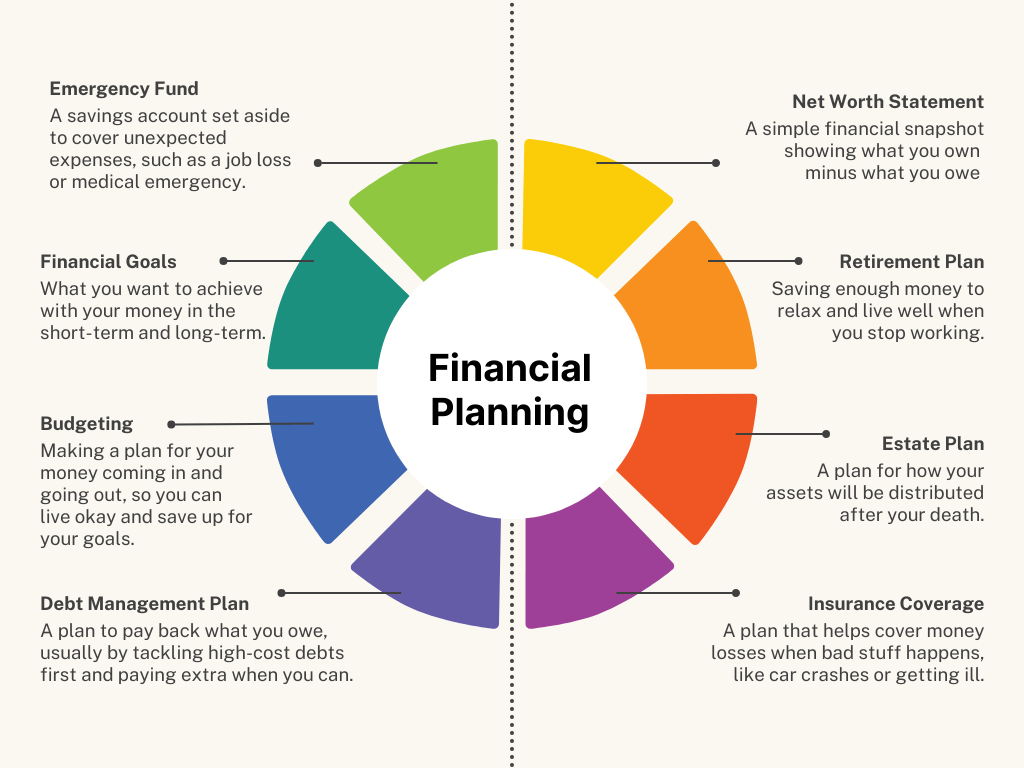

Planning resourses

Planning resources are tools, materials, or services designed to assist individuals and organizations in structuring, organizing, and executing their personal, financial, or business-related plans. These resources help streamline the process of goal-setting, identifying necessary steps, and tracking progress over time. Whether it’s planning for a personal project, managing a business, or organizing finances, effective planning resources provide clarity and direction, ensuring that objectives are met in a timely and efficient manner.

Benefits of Using Planning Resources

The primary benefit of using planning resources is enhanced organization and focus. They help break down complex tasks into manageable steps, ensuring that every action is aligned with the overall objective. These tools also help improve time management, allowing users to allocate their time more efficiently and meet deadlines without unnecessary stress. In a business context, planning resources support better decision-making by providing data-driven insights, such as cash flow projections or market analysis. For personal use, these resources make goal-setting and tracking more accessible, helping individuals maintain accountability and stay on course toward achieving their goals.

Benefits of Using Planning Resources

The primary benefit of using planning resources is enhanced organization and focus. They help break down complex tasks into manageable steps, ensuring that every action is aligned with the overall objective. These tools also help improve time management, allowing users to allocate their time more efficiently and meet deadlines without unnecessary stress. In a business context, planning resources support better decision-making by providing data-driven insights, such as cash flow projections or market analysis. For personal use, these resources make goal-setting and tracking more accessible, helping individuals maintain accountability and stay on course toward achieving their goals.